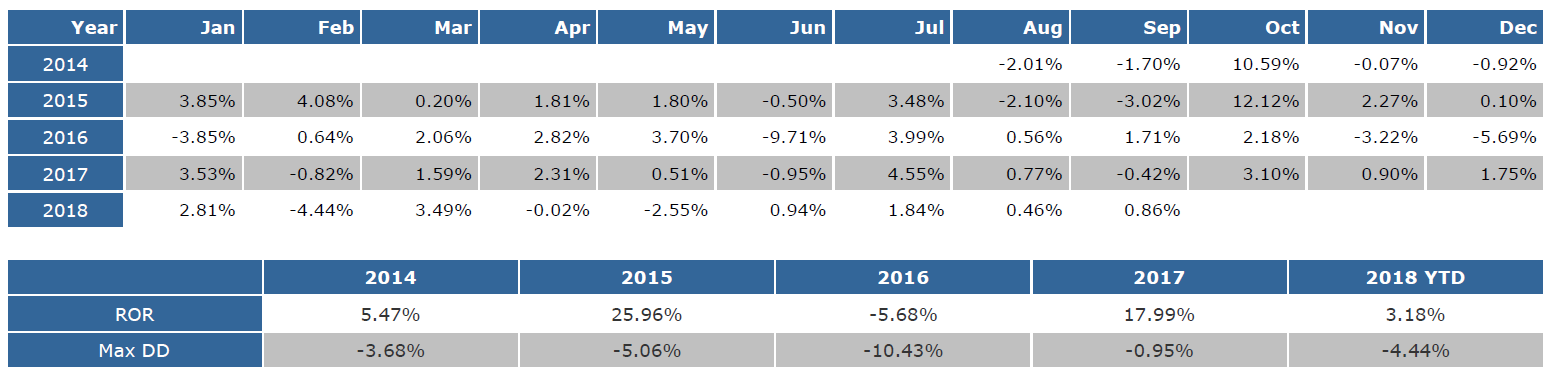

Managed Futures Program Description:

This Commodity Trading Advisor (CTA) Volatility Alpha program is a multi-strategy managed futures program that trades long and short positions in volatility futures, equity index futures and equity index options. The strategy centers around three essential characteristics of volatility: 1) Implied volatility tends to be higher than realized volatility causing options to be overpriced; 2) Volatility is mean reverting over the long-run; 3) Roll yield is a large component of VIX futures performance. The Program does not attempt to predict market movements, but rather utilizes a systematic approach to generate buy and sell signals based on rules devised from statistical and quantitative analysis. The objective of the CTA Program is to provide absolute returns throughout all market environments with low correlations to traditional asset classes.