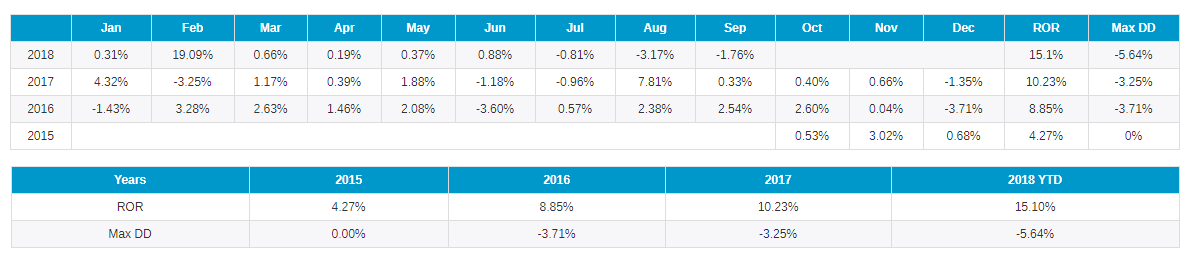

Managed Futures Program Description:

This Commodity Trading Advisor (CTA) program was built to seek greater diversification and a unique source of alpha. The Program is a futures-based, non-directional, and systematic strategy which seeks to monetize the mispricing of risk between implied volatility and realized volatility. Due to behavioral biases, investors routinely purchase unneeded investment protection during "risk-on" environments and fail to purchase needed protection during "risk-off" periods. This mispricing of risk is observable, is both behavioral and structural in nature, and is persistent over time. It structures trades which isolate both over/under mispricings and strip out market direction bias in the process. The result is a strategy which not only has the ability to provide solid returns in rising markets, but also has tail-risk-like properties to generate outsized returns during market turmoil. Therefore, the Program is designed to be "all-weather" and absolute return in nature. The Program boasts negative correlation to the S&P 500 and is also uncorrelated to CTAs, fixed income, and volatility strategies. The Program delivers true diversification and can benefit even the most diversified institutional portfolios.