Managed Futures Program Description:

The Commodity Trading Advisor (CTA) WEEKLY E MINI Program (“WEP”), Account Minimum $200,000, lesser amounts may be accepted at the sole discretion of the Advisor.

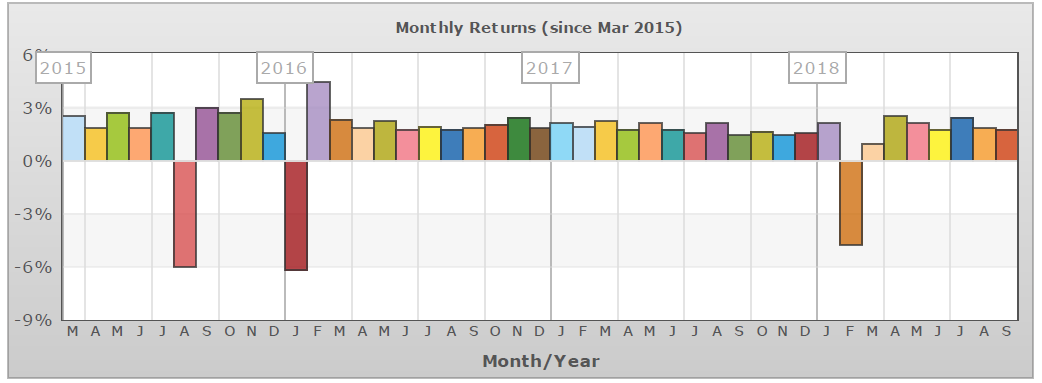

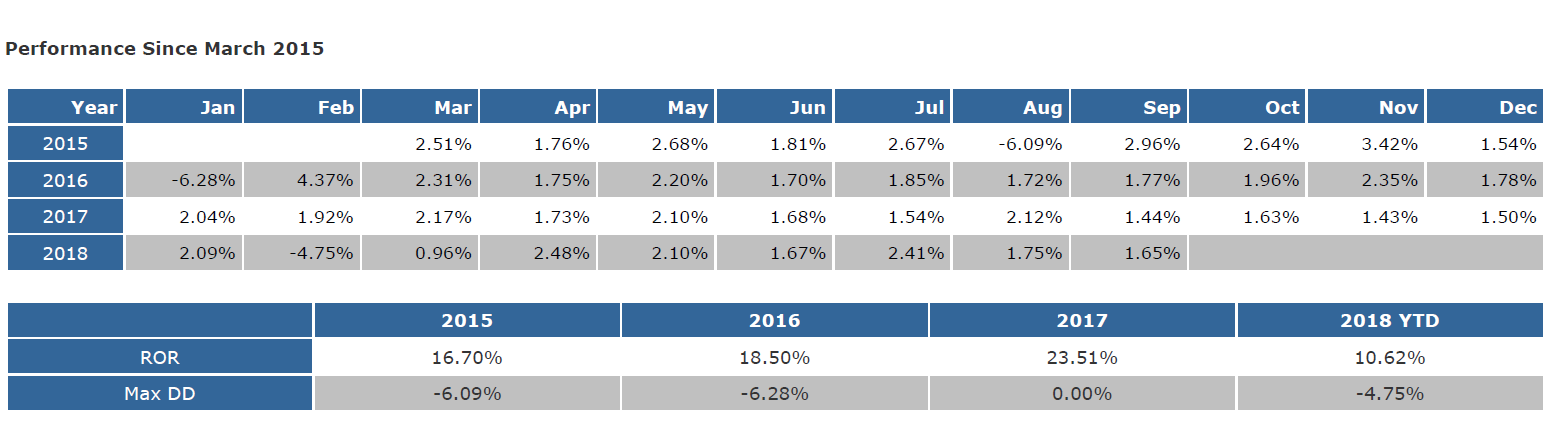

WEEKLY E MINI Program is guided by a proprietary trading model developed to trade the E-mini weekly volatility. WEP uses a proprietary options strategy to capitalize on the systematic entry signals produced by the program. WEP has been refined to achieve the desired returns while limiting account drawdowns. Products traded in WEP are E-mini S&P 500 futures and options. The strategy has been tested against 18 years of real data in attempt to achieve decent Sharpe Ratio (>3+).